Parents and Family

The W-Curve Model: Understanding a new college student’s experience

The W-Curve Model first was proposed in 1963 to explain adjustment to culture shock and later applied to first-year college students. It’s a predictable pattern of stages students go through in adapting to the new college culture. While each college student’s experience is distinctive, knowing about these typical and expected ups and downs can help make the transition to college more manageable.

Read More »How to help your college freshman when they’re homesick

“I hate it here; I want to come home.” These nine words uttered by a brand-new college freshman can break a parent’s heart. We watched our kids work hard; we supported them in their college journey, dropped off an excited teen only weeks ago, and…now this. They are homesick.

Read More »An RA’s best tips for helping roommates

Whether your student chose their roommate or is rooming with someone they never met, it can be intimidating to live in an unfamiliar place, away from home and surrounded by new people.

Read More »Returning home to the emptier nest

We know this day is coming. We hope for it, work hard for it, and yet…we can find ourselves wishing it away when it arrives. For 18 years, we prepare to take our kids to college. We cultivate their independence, encourage their achievements, and sit alongside them through the roller coaster ride of college admissions.

Read More »Register for Family & Friends Weekend

Families and friends are invited to the campus of Missouri S&T for an exciting weekend full of family friendly events. New this year, explore the Rolla community by participating in the Celebration of Nations Flag Challenge to collect cards from area businesses to enter a contest for a grand prize! Friday features an S&T Men’s […]

Read More »High school parent to college parent – let the celebration begin!

You’re excited. You’re proud. You’re nervous. You’re a wreck. You’re sad. You’re relieved. You’re happy!

Now shuffle all those emotions up and then turn on your brain overthinking function, and you have the summer before your teen leaves for college pretty much in a nutshell. Those last few days of impending change before the big shipping them off day are a roller coaster of angst and joy.

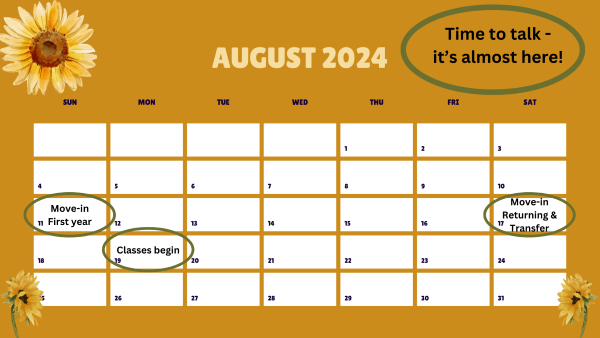

Let’s get real – conversations worth having

It’s almost here! Your student is looking forward to leaving your home soon for their first year of college. They are excited about meeting new friends, ordering late night pizza, and stepping out on their own. Which are all great, but let’s also be practical. To reduce misunderstandings or conflict, here are some nitty-gritty talking points you may want to discuss with your student before they leave for college.

Read More »Help your teen transition to college

The process of getting ready for college can be a time of true excitement for what’s to come, and yet it is a big life transition that we often forget to fully acknowledge. Adjusting to life away from home, managing a challenging academic load, balancing part-time or even full-time work, while also trying to make friends in an unfamiliar environment is overwhelming.

Read More »The benefits of volunteering for college students

When a student reflects on his or her college experience, what do they hope to remember? Lifelong friends, riveting classroom discussions, and walking across that stage to get their diplomas are all highlights of the university experience. But in today’s quickly evolving job market, there’s one thing students should be adding to their list of […]

Read More »7 Things to know about college accommodations

If your child had an IEP (Individualized Education Plan) or a 504 Plan in high school, you’ve been able to play a role in their educational process. You’ve had access to the people who are providing supports and services. And you’ve been able to monitor how well those supports were implemented.

Read More »